PHILADELPHIA (February 3, 2021) – Governor Wolf’s FY 2021-2022 budget proposal includes historic levels of investment that will improve the life chances of all children, especially children of color and low-income children in the commonwealth. It is hard to overstate the potential that this budget proposal has as a game changer for children.

The grand plan proposed by the Governor includes a tax increase in the state’s Personal Income Tax which is the lowest tax of its sort among all 50 states. As a result, the critical needs of our children that have historically been shortchanged in the state budget can begin to be adequately addressed. The Governor’s proposal shields hard-working and low-income parents from the burden of the tax increase that will fund the much-needed expansion in high-quality child care and Pre-K programs for working families and will prepare schools to open after the COVID crisis, retooled and ready to tackle the 21st century demands of public education.

The critical elements of the proposal will boost the vitality and productivity of the commonwealth because it invests in the future of the state and its children so they can be prepared for college, career, and a real life in our communities in the years ahead.

Wise Investments in the Most Formative Years

Governor Wolf’s $87 million investment in child care is a promising first step towards closing racial equity gaps in access to high-quality child care programs. These funds will increase the amount paid to child care providers caring for children whose parents are hard at work in entry level and moderate pay jobs. The bulk of these funds will be directed to child care providers at the lower end of the state’s quality rating scale, STAR 1 and 2 facilities, where 73% of Black children and 66% of Hispanic children are enrolled.

We look forward to companion state policies being advanced that ensure these lower quality providers begin to invest in the staff and programs that will enable them to increase their quality rating so that more children of color reap the proven benefits of high-quality early learning programs. The Governor’s budget proposal estimates the total number of children currently benefitting from high-quality child care to be only 27% of all children served.

For that reason, we commend the Wolf administration for this second child care rate increase in just three years, recognizing that the costs of running child care programs have continued to increase. This rate increase to providers does not cover the full cost of high-quality care, but progress to closing that gap is, nevertheless, good news.

In addition to increasing the rate paid to child care providers, the Governor is asking the legislature to raise the minimum wage to $12 an hour. Doing so would ensure that thousands of child care staff who are currently paid far less than $12 an hour would begin to be paid a respectable wage. This measure will retain qualified staff in the field and improve the early outcomes of our youngest children.

We urge lawmakers to build on the Governor’s proposal and enable an additional 3,000 babies and toddlers to enroll in high-quality care so their parents can rapidly return to work once the economy rebounds.

Governor Wolf’s proposal contains his seventh consecutive budget increase for Pre-K and Head Start by proposing an additional $30 million investment in these proven programs with the goal of enrolling 3,270 more children.

Across the five Southeastern counties, over 6,000 young children benefit from these state programs. The Governor’s proposal would expand by as many as 900 children in our region who can tap this smart start in life. Of the children in our region who will benefit from this expansion, more than 750 are likely to be children of color as they account for 83% of all children served by Pre-K and Head Start programs across the five counties.

Governor Wolf’s annual increases in Pre-K and Head Start have been consistent and impressive, still 60% of children in the state and 64% of children across the five counties are not able to enroll in these programs because state funds are in far too short of supply.

The Governor’s budget proposal also increases state matching funds for the federal Early Intervention Program for children ages 0-5 years old. Across the Departments of Education and Human Services the budget projects increasing the number of children served by just over 3,700 with both more infants and toddlers and pre-school-aged children benefitting from these critical early intervention services.

Children’s Health Care Access Sustained, More Progress Needed to Reach Every Child

The Governor’s budget proposal continues to make it possible for children to access Medicaid and CHIP, programs that are critical lifelines for PA children in low-income families. Most children enrolled in Medicaid are White (619,000 children), but Medicaid is the vehicle by which 64% of all Black and 61% of all Hispanic PA children access health care services.

The proposed funds for the subsidized CHIP program are projected to serve 10,000 fewer children than were insured through the program in 2019. While many more children are eligible for Medicaid since the state participates fully in the ACA Medicaid Expansion program, working families who make too much money to qualify for Medicaid must be able to rely on CHIP to insure their children. We urge lawmakers to ensure sufficient funds are provided in the CHIP program so all children in the state have health insurance.

To that end, Pennsylvania has a persistently high number of uninsured children (128,000); nearly 20% of them are uninsured because the commonwealth refuses to cover undocumented children. While the Governor does not mention the indirect costs of these children being denied insurance, the costs do exist, and taxpayers and health care providers end up paying the bill. We urge state lawmakers to expand public health insurance eligibility to the 24,000 PA children who are undocumented, promoting general health for children and financial stability for health care providers, which is needed more than ever during the pandemic.

The Governor’s Budget Office reports that only 20% of the state’s children are screened for lead exposure. While the budget proposal continues current Department of Health funds for lead surveillance, it does not include additional funds to ensure 100% of all children are screened for lead toxicity before they turn three years old. We urge lawmakers to improve state policy and direct resources to more rapidly ensure children are appropriately screened for a hazard known to negatively affect their development with lifetime consequences that harm children and increase social safety net costs to taxpayers.

On a local level, the Governor’s budget includes funds to establish a new local health department. PCCY has championed the need to open a health department in Delaware County, and these new state funds would be available to help the county finally deliver critical health services to families.

Unprecedented Investment in Public Education

The Governor’s proposal breaks decades of incremental increases and cuts by taking the bull by the horns and advancing a substantial plan that is a game changer for children of color and those who are low-income, while also decreasing the pressure on local property taxes.

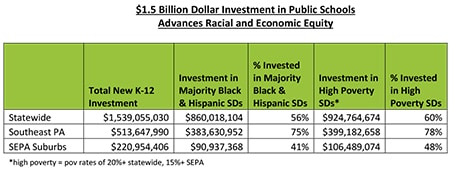

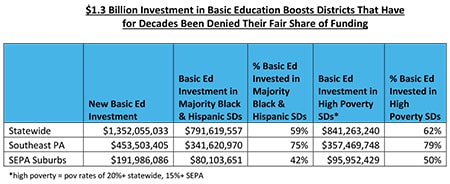

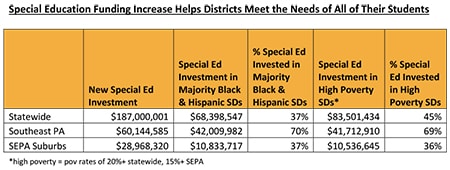

With a $1.5 billion increase in basic and special education funding overall, this budget proposal provides a much-needed increase of $900 dollars overall per student. The proposal includes a $1.3 billion increase in Basic Education Funding, the main line-item that supports public schools, and $200 million more in funds to meet the needs of special education students. This ambitious proposal dramatically chips away at the $4.6 billion shortfall in funds to Pennsylvania public schools.

Across the commonwealth, this historic investment would significantly benefit districts with a majority of Black and Hispanic students. These districts would receive more than $860 million, over half of the new funds.

Similarly, low-income students benefit as this plan directs $924 million of the $1.5 billion to districts educating the poorest students, getting them the resources they desperately need. (This is not on top of the $860 million, its simply another way to analyze how the total new funds are allocated to meet the needs of students.)

Overall, the plan puts new tax dollars to wise use, directing them to the districts that educate students who face the greatest barriers in life.

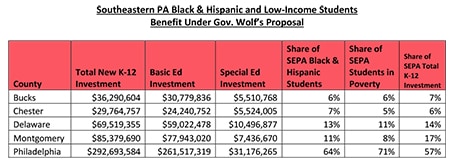

The 61 school districts in the four suburban Philadelphia counties are expected to receive $220 million. By allocating these funds via the state’s Fair School Funding Formula, which the Governor employs to its fullest extent, approximately 41% of this investment will be directed to the nine suburban districts where Black and Hispanic students are the majority. Of the more than $200 million expected for the suburban districts, $106 million will be allocated to the districts where at least 15% of the students are living in poverty.

In Philadelphia, where about 71% of students are Black and Hispanic and 36% of students live in poverty, the Governor’s proposal directs an additional $292 million to public schools. While this significant investment begins to close the access gap for Philadelphia’s students, it would take an additional $844 million to adequately meet their needs.

The Governor recognizes that state policies can effectively generate private resources to expand educational opportunities through the state’s Education Improvement Tax Credit Program. To increase the impact of that program, the Governor proposes limiting administrative expense costs to 5% of the total funds. Further, to ensure the funds are used to increase opportunity for the neediest students, the Governor is linking a $36 million increase in the tax credit program with new transparency requirements that capture the data and assure taxpayers that the $185 million are being used for their intended purpose.

What follows are some details on how the funds are allocated to school districts in our region:

Reforms to School Finance

Governor Wolf’s charter school funding reform package could save taxpayers $229 million annually, reducing pressure on local property taxes and leveling the playing field for local school districts and charter schools.

The Governor’s plan saves $130 million by setting a standard cyber charter tuition rate of $9,500. Currently, every school district pays a different cyber charter tuition rate that fails to reflect the actual costs of a cyber education. Adopting a standardized rate would reduce disparities and ease the burden on school districts.

The Governor’s plan also proposes to save local taxpayers $99 million in special education funding costs every year by requiring charter schools to use the same criteria as other public schools to calculate special education tuition rates.

These commonsense reforms do not threaten our children’s education, but they do stop the gaming of the school payment system that is putting pressure on local taxes, making it harder for seniors and working families to remain in their homes.

Governor Wolf’s fiscal reforms could reduce pressure in Southeastern PA where suburban school districts face a nearly $85 million increase in charter school tuition costs in 2020-21. Without the Governor’s recommendations, school districts in Bucks, Chester, Delaware, and Montgomery counties would have to raise property taxes by 2.34% to cover the hike in charter school tuition costs. Similarly, Philadelphia would have to raise property, wage or earned income taxes by as much as $100 million to cover higher charter school tuition costs.

Stemming the Rise of Children in Foster Care Due to Homelessness

When the COVID crisis is behind us and the eviction protections are lifted, thousands of families will risk homelessness because they are likely not able to afford to pay back rent owed to landlords. The Governor’s budget includes $1 million specifically to not only protect families from eviction and homelessness, but also prevent having their children taken and placed in foster care. These funds, to be administered by county child welfare agencies, are expected to “flatten the curve” of the anticipated increase in foster care placements due to housing instability.